A double-quick quiz to see if need to read this article or not – Is the following statement true? – Egalitarian societies are in general are more economically, socially and politically sound than those where inequality more pronounced.

A double-quick quiz to see if need to read this article or not – Is the following statement true? – Egalitarian societies are in general are more economically, socially and politically sound than those where inequality more pronounced.

If you answered false go here and evaluate the evidence for yourself. If you answered true, then the following will make sense. :)

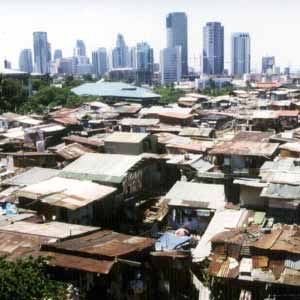

“Washington, DC – As evidence mounts that income inequality is increasing in many parts of the world, the problem has received growing attention from academics and policymakers. In the United States, for example, the income share of the top one per cent of the population has more than doubled since the late 1970s, from about eight per cent of annual GDP to more than 20 per cent recently, a level not reached since the 1920s.

While there are ethical and social reasons to worry about inequality, they do not have much to do with macroeconomic policy per se. But such a link was seen in the early part of the twentieth century: Capitalism, some argued, tends to generate chronic weakness in effective demand due to growing concentration of income, leading to a “savings glut”, because the very rich save a lot. This would spur “trade wars”, as countries tried to find more demand abroad.

From the late 1930’s onward, however, this argument faded as the market economies of the West grew rapidly in the post-World War II period and income distributions became more equal. While there was a business cycle, no perceptible tendency toward chronic demand weakness appeared. Short-term interest rates, most macroeconomists would say, could always be set low enough to generate reasonable rates of employment and demand.

Now, however, with inequality on the rise once more, arguments linking income concentration to macroeconomic problems have returned. The University of Chicago’s Raghuram Rajan, a former chief economist at the International Monetary Fund, tells a plausible story in his recent award-winning book Fault Lines about the connection between income inequality and the financial crisis of 2008.”

This is not about “socialism” or “communism” or any of the other words the business press has corrupted. This is about what has happened and what is happening now.

“Rajan argues that huge income concentration at the top in the US led to policies aimed at encouraging unsustainable borrowing by lower – and middle-income groups, through subsidies and loan guarantees in the housing sector and loose monetary policy. There was also an explosion of credit-card debt. These groups protected the growth in consumption to which they had become accustomed by going more deeply into debt. Indirectly, the very rich, some of them outside the US, lent to the other income groups, with the financial sector intermediating in aggressive ways. This unsustainable process came to a crashing halt in 2008.

Joseph Stiglitz in his book Freefall and Robert Reich in his Aftershock have told similar stories, while economists Michael Kumhof and Romain Ranciere have devised a formal mathematical version of the possible link between income concentration and financial crisis. While the underlying models differ, the Keynesian versions emphasise that if the super-rich save a lot, ever-increasing income concentration can be expected to lead to a chronic excess of planned savings over investment.

Macroeconomic policy can try to compensate through deficit spending and very low interest rates. Or an undervalued exchange rate can help to export the lack of domestic demand. But if the share of the highest income groups keeps rising, the problem will remain chronic. And, at some point, when public debt has become too large to allow continued deficit spending, or when interest rates are close to their zero lower bound, the system runs out of solutions.”

So, consider the implications of a monetary policy that encourages people not to hold onto gratuitous wealth. The 90% tax rate on 3 million and above seems a little less unseemly if it can spurn economic growth and development.

“This story has a counterintuitive dimension. Is it not the case that the problem in the US has been too little savings, rather than too much? Doesn’t the country’s persistent current-account deficit reflect excessive consumption, rather than weak effective demand?

The recent work by Rajan, Stiglitz, Kumhof, Ranciere and others explains the apparent paradox: Those at the very top financed the demand of everyone else, which enabled both high employment levels and large current-account deficits. When the crash came in 2008, massive fiscal and monetary expansion prevented US consumption from collapsing. But did it cure the underlying problem?

Although the dynamics leading to increased income concentration have not changed, it is no longer easy to borrow and in that sense another boom-and-bust cycle is unlikely. But that raises another difficulty. When asked why they do not invest more, most firms cite insufficient demand. But how can domestic demand be strong if income continues to flow to the top?

Consumption demand for luxury goods is unlikely to solve the problem. Moreover, interest rates cannot become negative in nominal terms and rising public debt may increasingly disable fiscal policy.

So, if the dynamics fuelling income concentration cannot be reversed, the super-rich save a large fraction of their income, luxury goods cannot fuel sufficient demand, lower-income groups can no longer borrow, fiscal and monetary policies have reached their limits, and unemployment cannot be exported, an economy may become stuck.”

Is this a hate the rich tract? No, it is not. It is an article merely identifying a probable framework behind what is going on in the US economy.

“The early 2012 upturn in US economic activity still owes a lot to extraordinarily expansionary monetary policy and unsustainable fiscal deficits. If income concentration could be reduced as the budget deficit was reduced, demand could be financed by sustainable, broad-based private incomes. Public debt could be reduced without fear of recession, because private demand would be stronger. Investment would increase as demand prospects improved.

This line of reasoning is particularly relevant to the US, given the extent of income concentration and the fiscal challenges that lie ahead. But the broad trend toward larger income shares at the top is global and the difficulties that it may create for macroeconomic policy should no longer be ignored.”

This article supports the idea that a more egalitarian society is a more healthy economic society. I just wonder if the US policy makers have enough political will to enact this possible solution to some of the economic problems facing the US.

8 comments

March 21, 2012 at 9:48 am

VR Kaine

“This article support the idea that a more egalitarian society is a more healthy economic society. I just wonder if the US policy makers have enough political will to enact this possible solution to some of the economic problems facing the US.

This is another lefty generality that sounds smart and nice but really doesn’t do much, You might as well be making the point that “when investing for our future, we should buy low and sell high.” Um, ok. Next?

What specifically is a “more” egalitarian society? What, using math and not rhetoric, do you need to do first to get there, and then next? Ask a liberal this question and you usually get yet another happy and yet vague utopian answer like, “Well for starters, we need to make sure more people can eat in this country”, or the current banter of how “We need to tax the rich.” Um, ok. Exactly how much? Taxing the rich 100% still won’t solve the problems, so what’s your next mathematical solution? When liberals someday get those numbers figured out, I’d love to see them.

Cynicism aside, I don’t have a problem with the statement itself, and if you spent any real time around conservatives or businesspeople you’d find that most of them don’t, either. Just as I don’t think that many liberals truly “hate” capitalism, I don’t think you’ll find many conservatives that have a problem with your statement at all. Rather, i suspect their problem would simply boil down to the fact that your side can never seem to truly quantify what “more” means. You want to find a common language between the two sides? Start with math.

With that, I’d say those old geezers laughing in your picture are not laughing at the concept of poor people eating, but rather, they’re laughing at 1) how liberals can’t seem to use a spreadsheet to save their lives, and 2) how easily distracted off-topic liberals can be by the bright shiny objects us conservatives put in front of them. Personally, I find those two things to be hilarious.

Liberal apathy and learned helplessness is what makes the concept of trickle-down economics fail the most. The strings were cut ages ago and yet liberals still all act like puppets. Consequently, while the usual liberal statements sound nice and could serve as a good starting point for a better society if liberals had any sort of credibility, thanks to this apathy and learned helplessness (towards calculators, for one) all these statements end up being reduced to t-shirt slogans or some hippie folk song lyrics sung at the next OWS rally.

Egalitarianism is a nice thought, but I don’t think it will never happen in the way you want it to. That’s not just my opinion – I think the world’s proved it over and over again.

LikeLike

March 21, 2012 at 10:45 pm

Rob F

In the 1930s in the US (that is, during the Great Depression), a number of populists arose. One of them was Louisiana Governor and Senator Kingfish Long. He founded a movement, “Share our Wealth” that was an explicitly redistributionist, Robin Hood program. He was very popular, and until his assassination in 1935, formed a secret with populist anti-Semitic radio host Charles Coughlin to deliberately split the Democratic vote in the 1936 election, (Long was popular enough to be predicted to get several million votes in an opinion poll, which would be enough to swing several states to the Republicans). Then, having proven the popularity of his platform, long would run in 1940.

Being aware of Long’s popularity and the left-ward movement of the US, one of the things Roosevelt did was to incorporate the left-wing rhetoric into his own, to convince people holding those views that they were part of his coalition, and to co-opt their leaders. This, in conjunction with the New Deal with improved people’s positions enough to prevent them from heading further to the left. This eliminated the third party threat enough (Lemke was buried in the 1936 landslide and got only around 2% of the vote) to prevent them from ever taking power. This was enough to prevent any sort of socialist or communist takeover from happening. In short, FDR saved capitalism (see here, for example).

The GOP economic plan of austerity for the poor, no safety net, plutocratic tax cuts, no redistribution, laissez-faireism, etc, only ever produces prosperity for a tiny elite (if at all). That is, those policies increase economic inequality. That minority prospers fantastically, and everyone else is little improved, or even envious and resentful of the elite. As Amy Chua mentions in her book World on Fire (within the specific context of the rich elite being an ethnic minority) This results in a backlash (not necessarily political, [for example, it could also manifest in criminal actions against the elite, demonstrations, etc), and demagogues will inevitably arise to take advantage of it if there are universal elections. If the demagogues take power, there could well trouble. There may be a backlash against the elite, or against capitalism, or, if there is no democratic culture, the elite de jure taking over.

However, when there is a safety net and redistribution, such a backlash is far less likely to occur. You don’t have to be a bloody communist to neutralize demagogues; even partial improvement in the non-elite reduces envy and resentment.

The examples show why the wingnut response to “resort to private charity” isn’t working. If the elite is giving to private charity, then private charity either isn’t doing enough to improve the majority’s position, or else is ineffective at improving people’s position. If private charity is ineffective at improving people’s positions enough to make a difference and neutralize demagogues, then perhaps something else (like government social programs) should be tried. For example, the program Oportunidades in Mexico, one of the most-studied social programs ever, has been fairly successful. The World Bank, of all institutions, likes the results, and calls them “extremely positive“. Hence, at least in the context of non-developed countries, it is entirely possible for government programs to be effective at improving people’s lots. Returning to the topic of economic elites, if the elite refuses to give or gives too little to charity to improve other people’s lives, then they are being phenomenally stupid as they are refusing to do the exact thing that in the long run would protect, (if that’s the appropriate term to use) them. If they really are that stupid, then I’m tempted to say they deserve what they get.

Western countries never had an economic elite that was also an ethnic minority, but is implicitly exporting the factors (ie a minority prospers fantastically) that will often result in a powder-keg in developing countries (demagogues arising). Since the factor of an ethnic minority being the prosperous elite is not present in western countries, it would be harder for a successful demagogue, but that is no barrier to their potential success (recall the US in the 1930s). In other words, I conclude that there is no specific barrier to demagogues arising from economic inequality in a country like the US.

Is a demagogic backlash really what anybody wants? In other words, the exact things the GOP resents and wants to eliminate is what is preventing revolution. To put it bluntly, no one will accept their inequality and a lack of improvement forever. You can support a welfare and redistribution, or you can roll the dice and go for the slightly more capitalist system where you get a plutocratic banana republic in which a tiny elite prospers fantastically and everyone else has no improvement. Just be aware that if you roll the dice, eventually you’ll lose.

Basically, preventing an excess of economic inequality is basically the best way to keep the free market going.

LikeLike

March 21, 2012 at 11:16 pm

The Arbourist

Whut? A progressive comment on my blog? How nice. :) Thanks for taking the time to write your thoughts and sharing them on this topic, somedays it seems I have to debate everything from square one with everyone on the net. :)

LikeLike

March 22, 2012 at 9:00 am

The Arbourist

This is another lefty generality that sounds smart and nice but really doesn’t do much,

Of course it is a generalization, based on the notion that the more egalitarian a society is, the better it is for all people – including the rich – in said society.

The link to the Equality Trust is chock full of evidence that supports this claim, along with countries that are currently practicing and are successful in the socioeconomic goals they choose to pursue.

Exactly how much? Taxing the rich 100% still won’t solve the problems, so what’s your next mathematical solution? When liberals someday get those numbers figured out, I’d love to see them.

A return to the 1950’s tax structure of 90% marginal taxation rate when earning over 3 million dollars, would be a start. Please check out the economic ruin such an onerous tax rate had on society.

Liberal apathy and learned helplessness is what makes the concept of trickle-down economics fail the most.

I would say that trickle down economics doesn’t work because – because concentrating wealth in a small segment is great for that small minority but bullocks for everyone else.

Egalitarianism is a nice thought, but I don’t think it will never happen in the way you want it to.

Other countries are successfully practicing more egalitarian policies, both social and economic, and are doing very well. It has been and can be done, what is required is the political will backed by the people to make it a reality.

LikeLike

March 23, 2012 at 11:58 am

Rob F

And regarding taxes, this is the approach I favour (the numbers used are merely examples to make the math easy; there’s nothing inherently special about them):

Eliminate every tax exemption and lump all income into one category. Tax all that at a flat rate. At the same time, pay everyone a fixed amount. This is what is known as a negative income tax.

Examples to explain:

Assume you make $30000 a year. You pay 25% of that in taxes ($7500). At the same time, the government gives you a guaranteed minimum income of %7500. These two numbers cancel out, resulting in no net taxes. If you make $40000 a year, you pay $10000 in taxes. You get the same $7500 back, which means you really pay $2500 in taxes (this is a de facto rate of 6.25%). If you make $20000 a year, you pay $5000. The government gives you $7500, which means you actually get $2500 from the government.

Such as system has the following improvements over the current regime:

*As can be seen from the examples, such a system is always progressive.

*Since it treats all income the same way, it eliminates much of the tax loophole industry, allowing a more efficient use of resources.

*For individuals, the entire tax system will much, much simpler. Pretty much anyone who can do percents and arithmetic can do their taxes. Tax software will be thrown out of work, and overall compliance is easier.

*It also eliminates some tax evasion, as there are no deductions to “hide” income in.

*All taxes distort the market somewhat, but this one does it less because it treats all income identically.

*It allows the elimination of welfare (like US food stamps, which are replaced by the guaranteed minimum income), pensions, and eliminates the need for a minimum wage. Since there are fewer programs and much less bureaucracy, it saves on administration costs. In other words, more bang for your (tax) buck.

*Such a system eliminates any welfare trap. A person always has an incentive to earn more incentive. Compare this with current systems, where welfare is clawed back once you start earning money in excess of a certain amount.

Such a negative income tax ought to make both right-wingers and left-winger happy. It helps the poor, and therefore accomplishes the goals of left-wingers. It results in a leaner, more efficient government, and therefore accomplishes the goals of right-wingers too.

LikeLike

March 23, 2012 at 1:55 pm

VR Kaine

“I would say that trickle down economics doesn’t work because – because concentrating wealth in a small segment is great for that small minority but bullocks for everyone else.

That comment just speaks to the what, not the why. The question to me is whether it’s a bad concept or bad execution, and in my opinion it’s more bad execution by the middle class than it is some insurmountable animal of greed at the top. Many in the middle class squandered the opportunities they had available to them over the past 20 years out of fear or apathy, I think, and as they say, “fortune favors the bold.”

“Other countries are successfully practicing more egalitarian policies, both social and economic, and are doing very well. It has been and can be done, what is required is the political will backed by the people to make it a reality.

We get back into the “more” argument here. Canada’s system is more egalitarian than the U.S.’s, but Canada doesn’t have to face off economically or militarily with countries like China or Russia. Granted, the argument remains as to whether or how much the U.S. has to, but I don’t thing comparing the U.S. to Finland, Sweden, or some other “we let others do our fighting for us” country is really an apples-to-apples comparison. Lessons to be learned? Sure, but I believe superpowers have to be gauged differently same as you do between large and small businesses.

“A return to the 1950′s tax structure of 90% marginal taxation rate when earning over 3 million dollars, would be a start.

You’ve put a big smile on my face by doing here, in one sentence, what most on the left don’t seem to want to do or haven’t done for the past 3 years, and that’s look at the threshold of what’s considered “rich” nowdays. You quantified it and picked a number ($3m). To me THAT’S a true starting point, and from there we could, I’d hope, constructively debate.

Now I’d caution that the world is not what it was in the 50’s (demographics are different, businesses are different, the economy is different), but I think you’d get a rational, considerate debate from anyone on the right over that statement and a discussion which would hopefully – assuming we were all at higher levels of power – bring on better policy.

Look where the public discourse is now, though. Your statement says something whereas the common lefty mantra of “Tax the rich” says nothing (and the righty mantra of “We already pay ‘too much’ says nothing also).

If OWS started pushing statements like these, I think we’d have a much better election coming up and a much stronger country going forward but unfortunately that dialogue just isn’t there.

LikeLike

March 23, 2012 at 2:10 pm

VR Kaine

Is anyone REALLY pushing for no safety nets, though, or is it more a problem of the right not having a clear enough message (or message at all) on what their safety nets would look like?

Ron Paul, for instance, seems to think the system would work with everyone going the charity route as you describe. I disagree with his position, starting most simply with that I think it goes against human nature. There’s a part of us that needs to be forced to help others, and I think most rational right-wingers would agree, which is why the ones I know are simply against excessive taxation rather than any taxation at all.

I like your thoughts about a different tax system as well. Ventures into the “flat tax” or “gas tax” area, no? Unfortunately, however, whether Canada or the US I think there are too many government positions beholden to the status quo to ever have that come to be, so I happen to be more along your lines of a flat or two-tier tax.

As I was saying to Arb, the problem I see is that the left and right aren’t starting from common, rational ground in the general public dialogue on these issues. Instead of arguing first about what the rich should pay, we should first be making sure we’re defining what “rich” is. Before saying what social nets we should be adding or taking away, we should be discussing what ones actually exist, and are they effective.

In the U.S. we (they) don’t have a budget, yet we’ve got three reports of government waste so far from the GAO and those have barely been mentioned or acted upon. We have how many new tax laws and regulations these past 3 years? Instead of a discussion on math and an election based upon the economy it’s an election on political ideology, and now once again, citizenship and birth certificates so far. And in the conversations I hear in airports and around water coolers all across the US, the general public seems to be eating it up, too, and ignoring the bigger issues. I’m a huge fan of the country, but it’s people are really making me nervous right now. :)

LikeLike

May 7, 2012 at 12:54 pm

Book Review: World on Fire « The Words on What…

[…] picture from Wikipedia. This post is based in part on a comment I made at Dead Wild Roses. Rate this: Like this:LikeBe the first to like this post. « […]

LikeLike