You are currently browsing the tag archive for the ‘Economics’ tag.

The first rule of focus groups or research groups is quite simply this. If you say yes to one, then you shall forever be on the call list of every research company that has ever existed. And they do call quite often. Extrapolating from the frequency that I receive offers, people who are willing to participate in studies and opinion groups are few and far between.

The first rule of focus groups or research groups is quite simply this. If you say yes to one, then you shall forever be on the call list of every research company that has ever existed. And they do call quite often. Extrapolating from the frequency that I receive offers, people who are willing to participate in studies and opinion groups are few and far between.

The call I received was from a company doing research on for the federal government of Canada. I thought to myself, woo-whee, the Feds want to know my opinion? How could I say no to that (well that and the included honourarium)? We were not told the details of what the discussion was going to be about beforehand. It turned out to be a rather mundane discussion on the tax system in Canada and what our opinions and thoughts were on it, along with other issues such as debt, sources of debt, and how well off we defined ourselves vis a vis other generations.

Fascinating (ish) stuff. What tweaked my interest was my fellow attendee’s lack of knowledge about Canadian fiscal and tax policy. Like the fact that Canada’s corporate tax rate is miserly 15%, among the lowest, if not the lowest in the G7. People seemed genuinely surprised when I suggested that we should be raising that tax rate significantly and that in the past the tax rate had been significantly higher (around 40% in the 60’s) .

Similar experiences when mentioning terms like neo-liberal (a la Nafta and the TPP) economic policy and trickle-down economics. None of the other people in my research cohort used terminology and concepts that named the economic features we were talking about. There was a good deal of, “oh I agree with what he said,” but none articulated the theoretical features or aspects of the features we were talking about.

The notion of ‘progressive taxation’ seemed to throw a few of my peers for a slight loop, even thought the Canadian tax system is nominally progressive in nature. I boggled inwardly at that, but we all got on the same page eventually when it came to nailing down the concept.

I’m worried though, I am by stretch of the imagination an economist or policy-wonk, but the amount of time spent getting people up to speed on basic economic features and concepts made me take pause. I get the feeling that many people just don’t have the time or the inclination to get the basic facts necessary to have an informed opinion on key features of our tax system and economics in general. Taxes affect everyone in society and not having a base level of knowledge about them and how government policy can change the way taxes work, seems like a glaring oversight in one’s life education.

Ignorance aside, 7 out of the 8 of us present agreed with the legalization of marijuana in Canada so the Feds will at least have positive affirmation that making pot legal makes most of us happy (representative samply-speaking).

Be it resolved – If the Private Sector is cutting jobs in a economic downturn then the Government of the day should also be cutting Public Sector.

Be it resolved – If the Private Sector is cutting jobs in a economic downturn then the Government of the day should also be cutting Public Sector.

This is my debate point. You won’t find it anywhere in the Alberta@Noon podcast I’m about to link here. I know most of you won’t be thrilled to hear about Alberta’s budget from the finance minister so instead, skip forward to 33:50 of the podcast when two guests, one from the Alberta Taxpayers Federation and one from the Parkland Institute are invited to respond to callers and engage in some debate.

The Alberta Taxpayers Federation (ATF) has shades of the Tea Party mixed in with neo-liberal dogmatic imperatives. Much of their ‘research’ comes from the equally dubious Fraiser Institute, a rightwing corporate skunk-works whose only aim is the complete corporitization of civil society. Listen as Paige from the ATF gets tripped up because her sloganeering has little to do with fact and much to do with stirring right-wing populist notions.

What I’d like to talk about is the caller ‘Mike’ and the following discussion (36:40 – 41:15). Mike is a plummer who lost his job and had to take a lower rate of pay with his job because of the downturn. Mike feels like a faceless drone supporting the ‘queen bee’ of that is the public sector because our recently elected provincial government stated in their platform that they would protect the frontline public workers and public services of Alberta.

Now here is the thing, Mike and other neophytes of the Free Market dogma, there is this thing called the business cycle. When you *choose* to work in the private sector you are choosing the insecurity that comes along with ups and downs of said business cycle. In terms of personal responsibility and making choosy-fucking-choices when the economy is good you will be doing good, and when the economy is bad, you’ll be doing bad too, generally speaking.

This is a choice. Contrast this with the public sector though, whose wages are generally lower and tend not to increase as quickly or dramatically with the ebb and flow of the business cycle. Public sector work therefore, is also a choice with related benefits and negative attributes. Stability over profitability, one could say.

Mike, you don’t get to turn around and demand that the people who have chosen to make less than you in good market conditions all of a sudden should share your pain when the economy isn’t so robust.

I’m not totally against Mike and what he has to say but I don’t think he’s looking at the big picture. Our government, for the last 41 years, has been taking a shit on basic Keynesian market prescriptions. When times are great, we lower taxes because we want to attract more business. When times are crap, we lower taxes to keep our businesses afloat.

Do you see the problem here? Lowering taxes during the Boom times royally screws the government and people of Alberta. How do we save for the economic downturns when we have lower revenue during boom times coming in; also lowering taxes during boom times increase the rate of inflation and makes the bubble expand that much quicker – recklessly endangering public health, infrastructure, and public services. The Anti-Keynesian aphrodisiac the old Alberta PC Party snorted by the bucketful, systematically razed the economic flexibility and resiliency of the province by tying the running of the government closely to the business cycle.

The false-populist beliefs that the ATF, represented by Paige on the podcast, are an extension of this seppuku inducing cycle that our old government perfected. What is fascinating to behold is the scepticism over what beneficial counter-cyclical government economic policy is actually supposed to look like. The government is supposed to spend more and take on debt to moderate the business cycle during economic slowdowns, conversely, the government must raise taxes during the high times to pay of accumulated debt and to moderate reckless growth and expansion during the boom times.

The false-populist beliefs that the ATF, represented by Paige on the podcast, are an extension of this seppuku inducing cycle that our old government perfected. What is fascinating to behold is the scepticism over what beneficial counter-cyclical government economic policy is actually supposed to look like. The government is supposed to spend more and take on debt to moderate the business cycle during economic slowdowns, conversely, the government must raise taxes during the high times to pay of accumulated debt and to moderate reckless growth and expansion during the boom times.

This is what moderating the business cycle is all about and why it is so important is because when you shave off the peaks and troughs, the people who make up the economy have a better chance of keeping things together and surviving in whichever phase the economy happens to be in.

This basic understanding of Keynesian market management is in the curriculum. I’ve been taught, and have taught it to students in this province. Why we elect governments (up till recently) that don’t apply this basic economic fact boggles my mind.

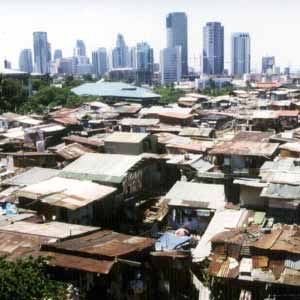

It is always nice to see the various economic classes looking out for one another. When the assets of the top are threatened, the bottom must suffer. Easy math, really.

This excerpt from an interview with Michael Hudson on Counterpunch.

Peries: Look forward to it, Michael. So Michael, some mainstream news outlets are saying that this is the China contagion. They need someone to blame. What’s causing all of this?

Hudson: Not China. China’s simply back to the level that it was earlier in the year. One of the problems with the Chinese market that is quite different from the American and European market is that a lot of the big Chinese banks have lent to small lenders, sort of small wholesale lenders, that in turn have lent to retail people. And a lot of Chinese are trying to get ahead by borrowing money to buy real estate or to buy stocks. So there are these intermediaries, these non-bank intermediaries, sort of like real estate brokers, who borrowed big money from banks and lent it out to a lot of little people. And once the small people got in it’s like odd lot traders in the United States, small traders, you know that the boom is over.

What you’re having now is a lot of small speculators have lost their money. And that’s put the squeeze on the non-bank speculators. But that’s something almost unique in China. Most Americans and most European families don’t borrow to go into the market. Most of the market is indeed funded by debt, but it’s funded by bank lending and huge, huge leverage borrowings for all of this.

This is what most of the commentators don’t get. All this market run-up we’ve seen in the last year or two has been by the Federal Reserve making credit available to banks at about one-tenth of 1 percent. The banks have lent to big institutional traders and speculators thinking, well gee, if we can borrow at 1 percent and buy stocks that yield maybe 5 or 6 percent, then we can make the arbitrage. So they’ve made a 5 percent arbitrage by buying, but they’ve also now lost 10 percent, maybe 20 percent on the capital.

What we’re seeing is that short-term thinking really hasn’t taken into account the long run. And that’s why this is very much like the Long-Term Capital Management crash in 1997, when the two Nobel prize winners who calculated how the economy works and lives in the short term found out that all of a sudden the short term has to come back to the long term.

Now, it’s amazing how today’s press doesn’t get it. For instance, in the New York Times Paul Krugman, who you can almost always depend to be wrong where money and credit are involved, said that the problem is a savings glut. People have too many savings. Well, we know that they don’t in America have too many savings. We’re in a debt deflation now. The 99 percent of the people are so busy paying off their debt that what is counted as savings here is just paying down the debt. That’s why they don’t have enough money to buy goods and services, and so sales are falling. That means that profits are falling. And people finally realized that wait a minute, with companies not making more profits they’re not going to be able to pay the dividends.

Well, companies themselves have been causing this crisis as much as speculators, because companies like Amazon, like Google, or Apple especially, have been borrowing money to buy their own stock. Corporate activists, stockholder activists, have told these companies, we want you to put us on the board because we want you to borrow at 1 percent to buy your stock yielding 5 percent. You’ll get rich in no time. So these stock buybacks by Apple and by other companies at high prices can push up their stock price in the short term. But when prices crash, their net worth is all of a sudden plunging. And so we’re in a classic debt deflation.

Mr.Chang is the author of the 23 Things They Don’t Tell You About Capitalism. It is a accessible book on Economics and economic theory that really, everyone should read. This brief twenty minute talk on understanding Economics is both necessary and enlightening.

Why is it that we bow down before the market? It is not a fundamental force of nature, yet we in society are instructed to think of it as such.

From a great interview on Alter.net –

From a great interview on Alter.net –

“LP: Some say that if we redistribute income in a more equitable way, people won’t want to work as hard. Is that true? What happens to our motivation to work when things are so inequitable?

JS: One of the myths that I try to destroy is the myth that if we do anything about inequality it will weaken our economy. And that’s why the title of my book is The Price of Inequality. What I argue is that if we did attack these sources of inequality, we would actually have a stronger economy. We’re paying a high price for this inequality. Now, one of the mischaracterizations of those of us who want a more equal or fairer society, is that we’re in favor of total equality, and that would mean that there would be no incentives. That’s not the issue. The question is whether we could ameliorate some of the inequality — reduce some of the inequality by, for instance, curtailing monopoly power, curtailing predatory lending, curtailing abusive credit card practices, curtailing the abuses of CEO pay. All of those kinds of things, what I generically call “rent seeking,” are things that distort and destroy our economy.

So in fact, part of the problem of low taxes at the top is that since so much of the income at the very top is a result of rent seeking, when we lower the taxes, we’re effectively lowering the taxes on rent seeking, and we’re encouraging rent-seeking activities. When we have special provisions for capital gains that allow speculations to be taxed at a lower rate than people who work for a living, we encourage speculation. So that if you look at the design bit of our tax structure, it does create incentives for doing the wrong thing.”

The burgeoning inequality in the US is rotting civil society away, the sooner the US decides to address the issue the better.

A double-quick quiz to see if need to read this article or not – Is the following statement true? – Egalitarian societies are in general are more economically, socially and politically sound than those where inequality more pronounced.

A double-quick quiz to see if need to read this article or not – Is the following statement true? – Egalitarian societies are in general are more economically, socially and politically sound than those where inequality more pronounced.

If you answered false go here and evaluate the evidence for yourself. If you answered true, then the following will make sense. :)

“Washington, DC – As evidence mounts that income inequality is increasing in many parts of the world, the problem has received growing attention from academics and policymakers. In the United States, for example, the income share of the top one per cent of the population has more than doubled since the late 1970s, from about eight per cent of annual GDP to more than 20 per cent recently, a level not reached since the 1920s.

While there are ethical and social reasons to worry about inequality, they do not have much to do with macroeconomic policy per se. But such a link was seen in the early part of the twentieth century: Capitalism, some argued, tends to generate chronic weakness in effective demand due to growing concentration of income, leading to a “savings glut”, because the very rich save a lot. This would spur “trade wars”, as countries tried to find more demand abroad.

From the late 1930’s onward, however, this argument faded as the market economies of the West grew rapidly in the post-World War II period and income distributions became more equal. While there was a business cycle, no perceptible tendency toward chronic demand weakness appeared. Short-term interest rates, most macroeconomists would say, could always be set low enough to generate reasonable rates of employment and demand.

Now, however, with inequality on the rise once more, arguments linking income concentration to macroeconomic problems have returned. The University of Chicago’s Raghuram Rajan, a former chief economist at the International Monetary Fund, tells a plausible story in his recent award-winning book Fault Lines about the connection between income inequality and the financial crisis of 2008.”

This is not about “socialism” or “communism” or any of the other words the business press has corrupted. This is about what has happened and what is happening now.

“Rajan argues that huge income concentration at the top in the US led to policies aimed at encouraging unsustainable borrowing by lower – and middle-income groups, through subsidies and loan guarantees in the housing sector and loose monetary policy. There was also an explosion of credit-card debt. These groups protected the growth in consumption to which they had become accustomed by going more deeply into debt. Indirectly, the very rich, some of them outside the US, lent to the other income groups, with the financial sector intermediating in aggressive ways. This unsustainable process came to a crashing halt in 2008.

Joseph Stiglitz in his book Freefall and Robert Reich in his Aftershock have told similar stories, while economists Michael Kumhof and Romain Ranciere have devised a formal mathematical version of the possible link between income concentration and financial crisis. While the underlying models differ, the Keynesian versions emphasise that if the super-rich save a lot, ever-increasing income concentration can be expected to lead to a chronic excess of planned savings over investment.

Macroeconomic policy can try to compensate through deficit spending and very low interest rates. Or an undervalued exchange rate can help to export the lack of domestic demand. But if the share of the highest income groups keeps rising, the problem will remain chronic. And, at some point, when public debt has become too large to allow continued deficit spending, or when interest rates are close to their zero lower bound, the system runs out of solutions.”

So, consider the implications of a monetary policy that encourages people not to hold onto gratuitous wealth. The 90% tax rate on 3 million and above seems a little less unseemly if it can spurn economic growth and development.

“This story has a counterintuitive dimension. Is it not the case that the problem in the US has been too little savings, rather than too much? Doesn’t the country’s persistent current-account deficit reflect excessive consumption, rather than weak effective demand?

The recent work by Rajan, Stiglitz, Kumhof, Ranciere and others explains the apparent paradox: Those at the very top financed the demand of everyone else, which enabled both high employment levels and large current-account deficits. When the crash came in 2008, massive fiscal and monetary expansion prevented US consumption from collapsing. But did it cure the underlying problem?

Although the dynamics leading to increased income concentration have not changed, it is no longer easy to borrow and in that sense another boom-and-bust cycle is unlikely. But that raises another difficulty. When asked why they do not invest more, most firms cite insufficient demand. But how can domestic demand be strong if income continues to flow to the top?

Consumption demand for luxury goods is unlikely to solve the problem. Moreover, interest rates cannot become negative in nominal terms and rising public debt may increasingly disable fiscal policy.

So, if the dynamics fuelling income concentration cannot be reversed, the super-rich save a large fraction of their income, luxury goods cannot fuel sufficient demand, lower-income groups can no longer borrow, fiscal and monetary policies have reached their limits, and unemployment cannot be exported, an economy may become stuck.”

Is this a hate the rich tract? No, it is not. It is an article merely identifying a probable framework behind what is going on in the US economy.

“The early 2012 upturn in US economic activity still owes a lot to extraordinarily expansionary monetary policy and unsustainable fiscal deficits. If income concentration could be reduced as the budget deficit was reduced, demand could be financed by sustainable, broad-based private incomes. Public debt could be reduced without fear of recession, because private demand would be stronger. Investment would increase as demand prospects improved.

This line of reasoning is particularly relevant to the US, given the extent of income concentration and the fiscal challenges that lie ahead. But the broad trend toward larger income shares at the top is global and the difficulties that it may create for macroeconomic policy should no longer be ignored.”

This article supports the idea that a more egalitarian society is a more healthy economic society. I just wonder if the US policy makers have enough political will to enact this possible solution to some of the economic problems facing the US.

Your opinions…