You are currently browsing the tag archive for the ‘Tax Dollars’ tag.

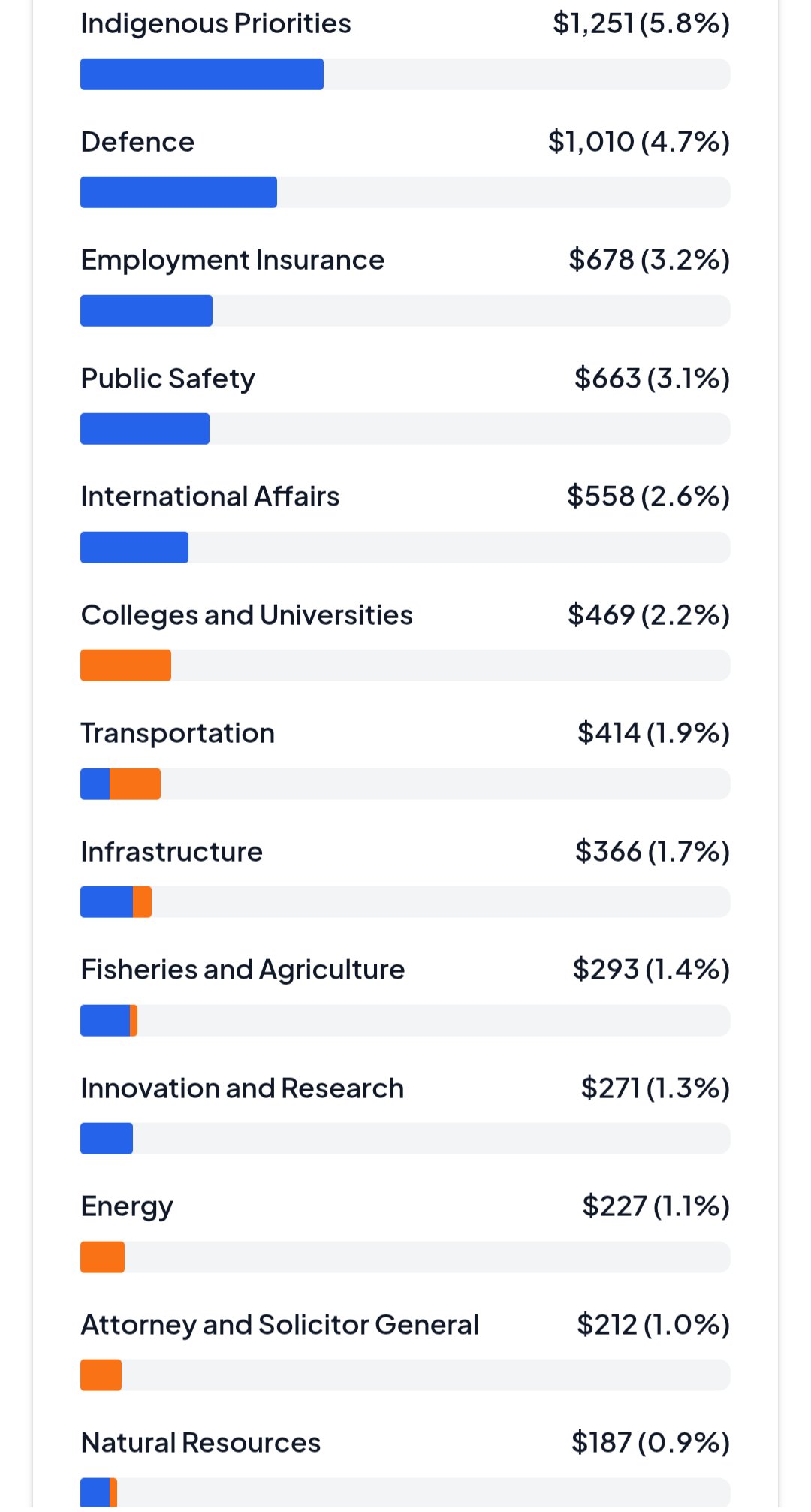

Canada’s federal budget tells a story that few seem willing to read critically. According to CanadaSpends.com, Ottawa allocates $1.251 billion—5.8 percent of the budget—to “Indigenous Priorities,” eclipsing even Defence ($1.010 billion, 4.7 percent). The arithmetic alone invites scrutiny. At what point does reconciliation become a fiscal reflex, untethered from measurable outcomes?

The Arithmetic of Imbalance

Consider a simple exercise in opportunity cost. Halving “Indigenous Priorities” to $625.5 million would free an equal amount—$625.5 million—for redeployment elsewhere. Redirecting that sum to Public Safety, currently $663 million (3.1 percent), would nearly double its capacity to $1.288 billion. The outcome: stronger policing resources, reinforced border security, and potentially measurable reductions in crime—objectives grounded in deterrence rather than symbolism.

This is not an argument against Indigenous advancement. It is an argument for proportionality and accountability. “Indigenous Priorities” now consume more than Employment Insurance ($678 million), International Affairs ($558 million), and Colleges and Universities ($469 million) combined. Defence, tasked with national sovereignty, trails by $241 million. When cultural or consultative programs eclipse citizen security and education, something in our fiscal compass is misaligned.

The Accountability Deficit

Proponents will cite historical redress, and that moral claim has force. But truth in budgeting requires evidence, not sentiment. Where are the audited outcomes showing that each billion spent yields measurable gains in Indigenous health, education, or economic independence?

The problem is not merely bureaucratic inertia—it is structural opacity, worsened by political choice. In December 2015, the newly elected Liberal government suspended enforcement of the First Nations Financial Transparency Act, which had required Indigenous governments to publish audited financial statements and leadership salaries. The minister at the time, Carolyn Bennett, directed her department to “cease all discretionary compliance measures” and reinstated funding to communities that refused disclosure.

In effect, Ottawa dismantled the only system ensuring public visibility into how billions of tax dollars are spent. Nearly a decade later, the Auditor General’s 2025 report found “unsatisfactory progress” on more than half of all Indigenous-services audit recommendations, despite an 84 percent increase in program spending since 2019. The data are undeniable: accountability has eroded even as expenditures have soared.

Fiscal Compassion, Not Fiscal Indulgence

Canada does not need less compassion; it needs measurable compassion—spending that demonstrably improves lives rather than perpetuates dependency. Halving the current Indigenous Priorities budget would not abolish support or reverse reconciliation. It would introduce accountability, allowing funds to be reallocated to public safety, infrastructure, or innovation—areas with immediate and empirically verifiable benefits.

Until Indigenous programs are evaluated with the same rigour applied to defence, education, or social insurance, billion-dollar gestures will remain ends in themselves—virtue without verification.

References

- CanadaSpends.com – Federal Tax Visualizer

- Government of Canada Statement on the First Nations Financial Transparency Act (2015)

- Office of the Auditor General of Canada, 2025 Report – Programs for First Nations

- Canadian Affairs News – Poll: Canadians Want Transparency in First Nations Finances (2025)

- Standing Committee Appearance: Supplementary Estimates (2024)

- Crown-Indigenous Relations and Northern Affairs Canada 2023–24 Results Report

Your opinions…